income tax calculator uk

Ad Need Software for Making Tax Digital. Our salary calculator indicates that on a 589872 salary gross income of 589872 per year you receive take home pay of 316581 a net wage of 316581.

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

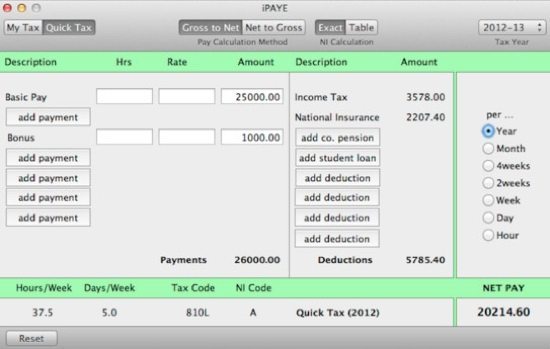

This calculator calculates the Income Tax and National insurance based on the tax rates and bands in England Northern Ireland.

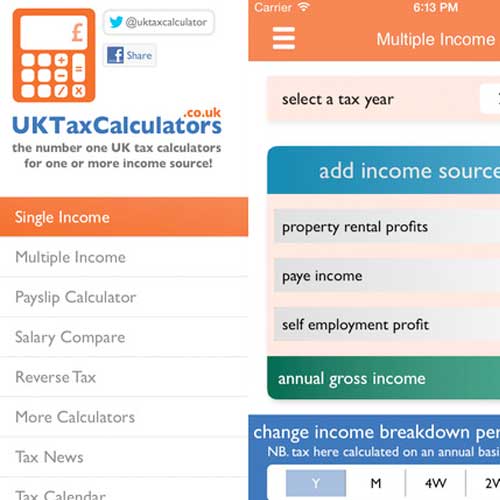

. Income Tax Calculator UK is an online tool that can help you Calculate Salary After Tax UK. Fill in gross income and hours per week select the period and the salary after tax. Read customer reviews find best sellers.

Salary Take Home Pay. Easy to use UK tax returns software Price from 1495 plus VAT. Self-Assessment Tax Calculator QuickBooks UK.

File VAT returns online using HMRC compatible software such as Xero. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. See where that hard-earned money goes - with UK income tax National Insurance student.

File VAT returns online using HMRC compatible software such as Xero. This guide is also available in Welsh Cymraeg. The total tax you owe as an.

If you earn 40000 a year then after your taxes and national insurance you will take home 30879 a year or 2573 per month as a net salary. Free shipping on qualified orders. Ad Browse discover thousands of brands.

Free easy returns on millions of items. Calculate your tax National Insurance and take-home pay. For example if you earn 6000 a year youre not taxed.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. It asks for your income along with any taxable benefits or deductions you may have as well as any. Specifically weekly earnings of 242 to 967 face a 1325.

Calculate your take-home pay after deductions such as national insurance income tax pension contributions and student loans with our FREE tool. Income Tax is a tax you pay on your income. Use HMRC-approved software such as Xero.

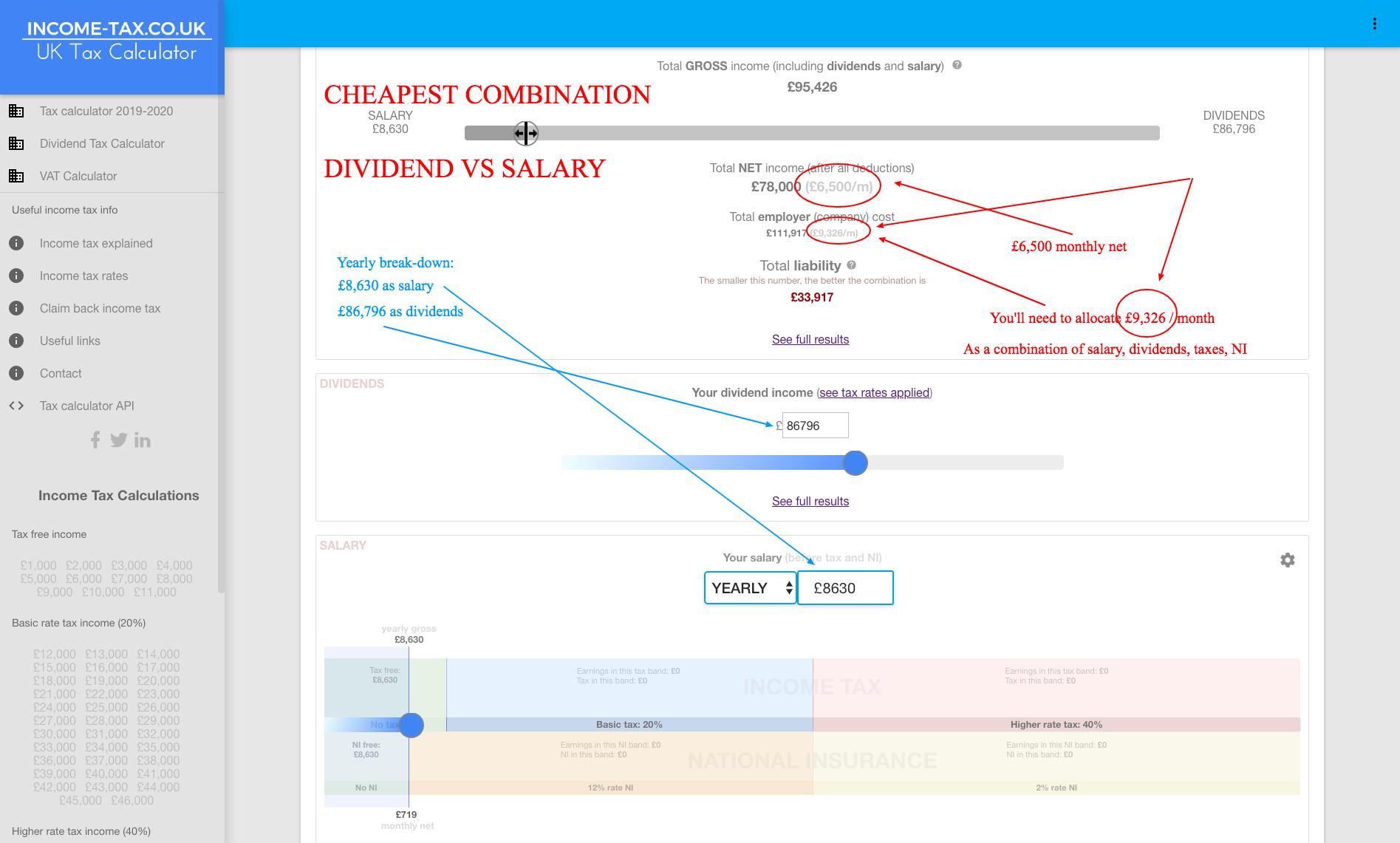

As a result working out your income tax and other costs can become quite tricky. Its important to remember when calculating your taxes that the rates only apply to a portion of your income and not the whole amount. The UK has a complex tax system.

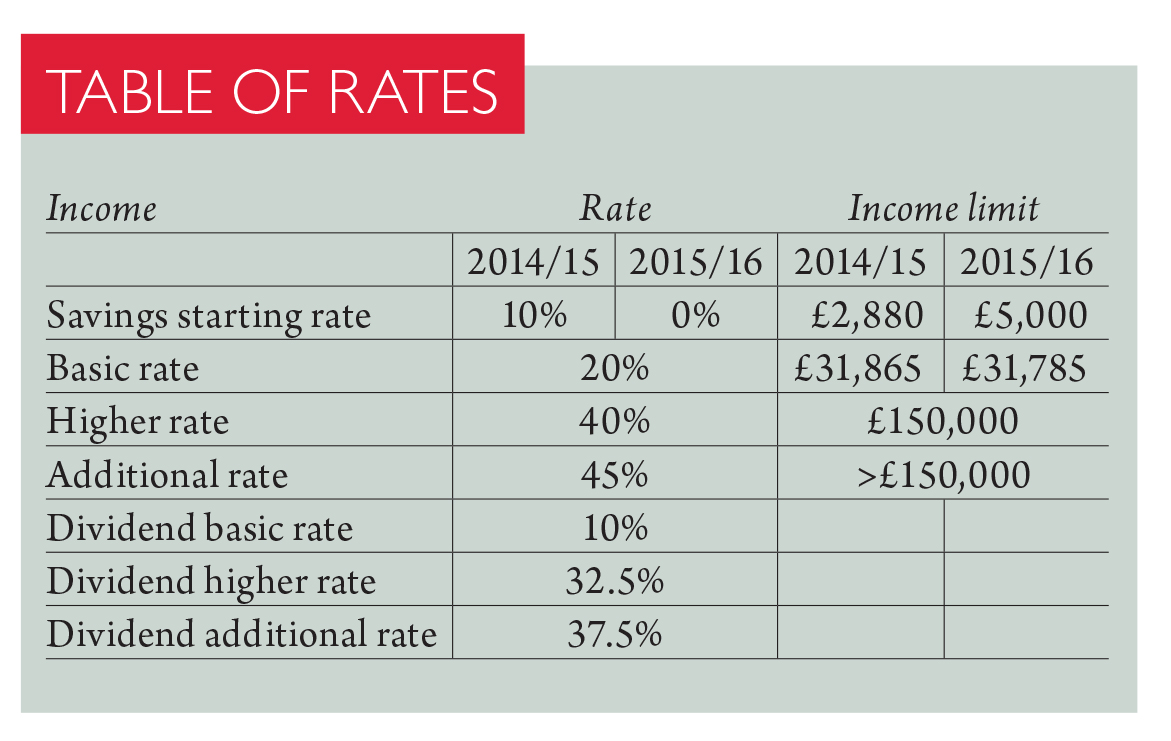

You do not have to pay tax on all types of income. Tax calculation summary for 40000 Yearly salary. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate.

By using the calculator above you are able to calculate your income tax. Between 50271 and 150000 youll pay at 40 known as the higher rate and above. Salary Calculator Our salary calculator calculates your.

Student loan pension contributions bonuses company. We have a passion for excellent client care and UK tax Returns. The calculator estimates your net pay based on your employment income.

The UK business tax section of iCalculator contains tax calculators and tax guides which provide clear details of business tax responsibilities with a view to helping business owners. Note that for UK income above 100000 the Personal Allowance reduces by 1 for every 2 of income above the 100000 limit. You pay tax on things like.

Updated for the 2022-2023 tax. The Class 1 National Insurance rates which apply to most employees range from 0 to 1325 depending on your income. Ad We have a passion for excellent client care and UK tax Returns.

Use HMRC-approved software such as Xero. Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans. Ad UK personal tax returns calculation software Price from 1495 plus VAT.

Ad Need Software for Making Tax Digital.

How To Calculate Income Tax In Excel

Six Apps To File Taxes On The Mac Chriswrites Com

Comparison Of Uk And Usa Take Home The Salary Calculator

Income Tax Calculator Uk Best Sale 57 Off Ilikepinga Com

Tax Calculator 2021 Work Out Your Take Home Pay After Tax

Income Tax Calculator Uk Best Sale 57 Off Ilikepinga Com

Federal Income Tax Return Calculator Nerdwallet

Tax Cuts And Jobs Act Did Little To Affect Executive Pay Counter To What Congress Intended Eurasia Review

Top 6 Best Uk Tax Income Mortgage Calculators 2017 Ranking Top Uk Online Financial Calculators Advisoryhq

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

Income Tax Calculator Uk Best Sale 57 Off Ilikepinga Com

Income Tax Calculator Uk Best Sale 57 Off Ilikepinga Com

Calculate Uk Income Tax Using Vlookup In Excel Progressive Tax Rate Youtube

I Just Found Out That In The Uk You Are Paying 45 Taxes If You Are Making 150 000 Pounds Is That True Does That Mean That You Are Receiving Only 82 000 Pound

Income Tax Uk Incometaxuk Twitter

Income Tax Calculator Uk Best Sale 57 Off Ilikepinga Com

Income Tax Calculator How Much Will Kwasi Kwarteng S Cuts Save You Personal Finance Finance Express Co Uk